Monetary policy as a catalyst for the markets

As expected, the monetary policies of the various Central Banks took centre stage on the financial markets in the first part of 2023. Investors have closely scrutinised their every move and have tried to read between the lines of the Central Banks' various speeches in order to navigate in a macroeconomic environment that is still very uncertain.

In this performance note, Birdee helps you to understand the major issues of the first half of 2023 and the impact they may have had on your investments.

Central banks play tightrope walker

The major macroeconomic issues remain fundamentally the same as in 2022, namely excessively high inflation and signs of economic stagnation. This economic context makes the task of the Central Banks particularly complex. They have to use their monetary policy tools to reduce inflation while avoiding plunging the economy into too violent a recession.

In January, data indicating a possible slowdown in the economy and a downturn in inflation gave hope to investors, who saw this as a sign of less aggressive monetary tightening. The result was a spectacular surge in equity markets (+7.1% for the MSCI World index, the second-best month of January after 1988).

This euphoria came to a screeching halt in February. Surprisingly solid economic indicators, such as exceptionally strong job creation in the US, an improvement in business surveys and the resilience of European economies to the energy shock, dashed hopes of a slowdown in rate rises. Bond yields rose sharply, while equity prices corrected substantially.

These first two months of 2023 are typical of current market dynamics. Investors are concentrating their energy on trying to determine when interest rate rises will slow down or come to an end, and every event, positive or negative, that deviates from their projections triggers market movements.

The Central Banks, for their part, imperturbably maintained their restrictive policies throughout the period. There were several successive rate hikes, justified by stubborn underlying inflation well above the levels considered acceptable. Nevertheless, there was a noticeable change in the tone of their communication. While, in the first few weeks of 2023, the Central Banks remained firm on their objective of guaranteeing price stability and warned that further hikes were envisaged, increasingly, a reaction strategy based on periodic economic indicators is beginning to take shape.

The spectre of a banking crisis and US debt shake the markets, and tech comes to the rescue

In the second week of March, the spectre of the 2008 financial crisis briefly reappeared in the minds of investors. The liquidation of Silicon Valley Bank, a Californian regional bank whose main commercial relationships were with companies active in the technology and cryptocurrency sectors, sent a wave of panic through the markets. A victim of massive withdrawals prompted by fears of financial difficulties linked to its commercial positioning, the banking institution was forced to sell off its assets on a massive scale, which consisted mainly of Treasury bonds that fell sharply in value during 2022, generating considerable losses. The bank's liquidity position became untenable, leading to its bankruptcy.

Almost simultaneously, Silvergate Bank and Signature Bank also went bankrupt after a series of similar events. At the beginning of May, it was First Republic Bank's turn to close up shop, its assets having been bought by JP Morgan Chase. The troubles of these US regional banks, although relatively modest in relation to the country's economy, have had a knock-on effect on the European banking sector.

On 15 March, Crédit Suisse's share price fell by almost 30% following the announcement by its main shareholder that it would not increase its stake. The bank's difficulties date back to 2014, when it was fined $2.6 billion in the United States for aiding tax evasion by US citizens. In 2021, the Swiss bank suffered losses of €4 billion following the collapse of the Archegos Capital investment fund. At the end of 2022, Crédit Suisse announced further financial losses and, above all, considerable withdrawals of funds. This string of financial losses and scandals, coupled with the difficulty of refinancing itself, led to the bank's downfall. As it was considered a systemic financial institution, news of its difficulties spread like wildfire and the entire sector shook. Finally, at the instigation of the Swiss federal government, Crédit Suisse was bought out by UBS. The takeover ultimately reassured the markets, despite a controversial decision by the Swiss banking authority to write down the value of subordinated debt issued by Crédit Suisse.

It is important to note that on both sides of the Atlantic, the public authorities fulfilled their role of reassuring investors and savers in order to avoid a contagion of massive withdrawals from sound banking institutions.

Once these fears of a systemic banking crisis had been allayed, investors turned their attention to the US debt ceiling. Although highly unlikely, a US default would trigger an earthquake in the financial markets. In reality, the discussion of raising the debt ceiling is eminently political. Nonetheless, this event caused a high level of volatility until it was resolved at the very beginning of June.

Lastly, after struggling in 2022, the major technology companies experienced a veritable resurrection at the start of 2023. The prospects of lower inflation, but above all the rise of artificial intelligence and investors' unprecedented enthusiasm for this technology, have inflated the valuations of companies active in the sector. These exceptional performances are behind the very good figures posted by the major US market indices, particularly the Nasdaq (+32.74%), which is heavily exposed to the technology sector.

Economic indicators that are difficult to interpret

The possibility of an economic slowdown of greater or lesser magnitude remains at the centre of discussions, but no consensus is emerging. The fault lies in the fact that economic indicators are fluctuating up and down.

As far as inflation is concerned, it would appear to have begun to fall, mainly in Europe. The year-on-year downtrend in goods prices began a few weeks ago. What is new is that service prices are also beginning to follow this trend.

However, underlying inflation (excluding energy prices) remains very high, and its decline is proving slower than expected, which explains the European Central Bank's (ECB) determination to continue its restrictive monetary policy. In the UK, the situation remains complicated, as evidenced by higher-than-expected price levels, which led to a surprise 0.5% interest rate hike by the Bank of England in June. This shook up European and US government bonds.

The expected consequence of monetary tightening policies is a deterioration in economic activity. Observations on this subject differ between regions and sectors. In the US, employment figures are in great shape and are providing strong support for domestic demand, which is why economists have revised GDP estimates upwards. Nevertheless, employment data is becoming increasingly volatile, and there is some divergence in the results of activity surveys between the manufacturing and service sectors.

The European economy, meanwhile, is clearly more fragile, as evidenced by the entry into technical recession of Germany, the Old Continent's largest economy. Domestic demand in the Eurozone has contracted, with the same disparities between sectors as in the United States (with the manufacturing sector suffering more than the services sector). In the spring, the European Commission (EC) stressed that "the downside risks to the economic outlook have increased".

This difficulty in identifying a clear trend in global economic activity against a backdrop of stubborn inflation and, it should be remembered, ongoing geopolitical tensions, has given rise to a wide range of medium-term prospects. On the financial markets, this uncertainty is reflected in sudden movements, both upwards and downwards, as new information becomes available and investor sentiment changes.

Our portfolio returns in 2023

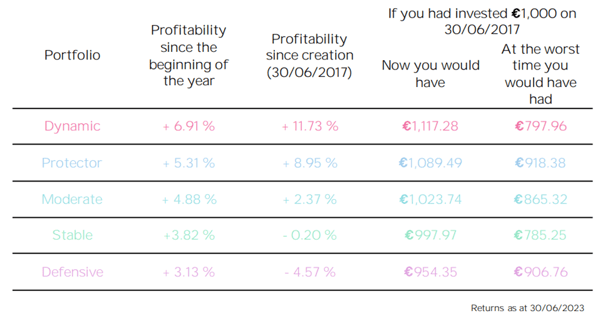

The Birdee portfolios posted positive returns for the first half of 2023.

The Dynamic portfolio turned in the best performance of the period. The resilience of the world economies and the lower proportion of bonds in its allocation enabled it to benefit more from the current market environment.

For the Moderate portfolio and its two satellites (Protector and Stable), observations diverge. The Moderate portfolio also managed to benefit from its equity component, but also from its European corporate bonds. The Protecteur portfolio performed well for its level of risk. Its 'quality' US equities component, in which the technology sector predominates, was able to benefit fully from the wave of investor enthusiasm for artificial intelligence. The Stable portfolio was slightly down over the period, as its specific allocation pocket, composed mainly of dividend-paying 'value' stocks, suffered somewhat in the first half of 2023.

The Defensive portfolio was able to play its role as a safe haven, despite its high bond component. In fact, this portfolio was not only the least volatile, but also the one with the lowest maximum potential loss over the period. Its European equity and bond components enabled it to generate positive returns for a low level of risk.

Attentive investors will no doubt have noticed that the major equity market indices have slightly outperformed over the period. The companies in which the ETFs in our portfolios are invested have been selected for their ESG attributes (compliance with environmental, social and governance standards). By their very nature, these companies share a 'growth' profile: they are innovative companies financing ambitious sustainable development plans. Their stock market valuation depends more on their estimated future revenues than on their current book value. The translation of these future revenues into valuation is closely (and negatively) linked to interest rate movements. Conventional equity market indices, on the other hand, do not distinguish virtuous companies from others: they are made up of the largest capitalisations, which are less sensitive to interest rate movements.

Challenges of the second half of 2023

In Europe and the United States, market dynamics are likely to be fairly similar in the second half of the year. Investors will continue to scrutinise the every move of the various Central Banks and adjust their forecasts on the basis of the activity reports and figures published.

China will also be the focus of attention. The economic recovery following the abandonment of the 'Zero Covid' policy has so far been disappointing. Indeed, in a rather gloomy global economic context, domestic demand does not appear to be sufficient to revive the industrial machine of the world's second largest economy. To

bolster activity, the government has decided to cut interest rates on loans and drastically reduce taxes on the purchase of new electric vehicles in order to support the property and automotive sectors, which are struggling to recover from the health crisis.

Still in Asia, Japan, with its ultra-accommodating monetary policy and very good corporate results buoyed by a weak yen, is performing very well on the markets, with the best stock market results among the developed markets. The Nikkei 225, Japan's benchmark index, has reached levels not seen since 1990. All eyes will now turn to the Bank of Japan and its monetary policy. Its new governor, Kazuo Ueda, will be tempted to move away from the current ultra-accommodative monetary policy in order to respond better to inflation, which is starting to grow beyond the bank's targets. Nevertheless, the consensus remains positive over the long term. Corporate profitability and governance underpinned by stimulating economic policy, coupled with growing interest from foreign investors, should mitigate the potential correction from a less accommodative monetary policy.

As we can see, the macroeconomic context is difficult to understand and varies widely from one market to another, which is making investors nervous. That's why it's important to keep a cool head and behave rationally. An investment horizon that is consistent with the risk in your portfolio and sufficient diversification of your investments, both in terms of geographical zones and asset classes, remain the most effective ways of protecting yourself against specific and isolated risks.

We would also like to thank you for your confidence in Birdee and remain, as always, at your disposal to answer any questions you may have.

Birdee Team

English

English